A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum of 30 on chargeable income exceeding RM2000000 with effect from YA 2020. Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any.

Thailand S New Personal Income Tax Structure Comes Into Effect Asean Business News

In Malaysia 2016 Reach relevance and reliability.

. Additional RM2500 tax relief for purchases of personal computers laptops smartphones and tablets made between 1 June 2020 until 31 December 2021. Principal hubs will enjoy a reduced corporate tax rate of 0 5 or 10 rather than the standard corporate tax rate of 24 effective from year of assessment 2016 for a. Wealthy to pay more income tax.

Malaysia Brands Top Player 2016 2017. Any individual earning a minimum of RM34000 after EPF deductions must register a tax file. Home Income Tax Income Tax Rates.

Wef YA 2016 tax rates for resident individuals whose chargeable income from RM600001 to RM1000000 be increased by 1 and chargeable income exceeding RM1000000 increased by 3. Lowest Individual Tax Rate is 2 and Highest Rate is 26 for 2014 and Lowest Tax Rate for Year 2015 is 1 and Highest Rate is 25. Effective from year of assessment 2015 individual income tax rates will be reduced by 1 to 3.

As a non-resident youre are also not eligible for any tax deductions. Receiving tax exempt dividends. Income Tax Rates and Thresholds Annual Tax Rate.

If you have any other questions regarding personal income tax for the 2016 assessment year feel free to drop them in the comments section down below. An individual whether tax resident or non-resident in Malaysia is taxed on any income accruing in or derived from Malaysia. Maximum tax bracket will be increased from exceeding RM100000 to exceeding RM400000.

The current maximum tax rate at 26 will be reduced to 24 245 and 25. The fixed income rate for non-resident individuals be increased by three percentage points from 25. Tax relief for each child below 18 years of age is increased from RM1000 to RM2000 from year of assessment 2016.

Below are the IndividualPersonal income tax rates for the Year of Assessment 2013 and 2014 provided by the The Inland Revenue Board IRB Lembaga Hasil Dalam Negeri LHDN Malaysia. Foreigners with a non-resident status are subjected to a flat taxation rate of 28 this means that the tax percentage will remain the same no matter the amount of income. The maximum income tax rate is 25 percent and applies to an adjusted chargeable income of MYR 400000 or more 28.

Personal income tax rates. Effective from year of assessment 2016 company tax rate will be reduced by 1 from. 2016 and has been updated on January 2 2020.

A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an. New Malaysia Personal Income Tax Rates 2016 Assessment Year 2015. The fixed income tax rate for non-resident individuals be increased by 3 from 25 to 28 from YA 2016.

On the First 5000. The following rates are applicable to resident individual taxpayers for YA 2021. Here are the progressive income tax rates for Year of Assessment 2021.

Please find the Latest Personal Tax Rates Table below for details. Malaysia Personal income tax rates 20132014. A Firm Registered with the.

Printed in Malaysia by SP-Muda Printing Services Sdn Bhd 906732-M 82 83 Jalan KIP 9 Taman Perindustrian KIP Kepong 52200 Kuala Lumpur. The current maximum tax rate at 26 will be reduced to 24 245 and 25. Malaysia uses both progressive and flat rates for personal income tax PIT depending on an individuals duration and type of work in the country.

Starting from 0 the tax rate in Malaysia goes up to 30 for the highest income band. Calculations RM Rate TaxRM 0 - 5000. Technical or management service fees are only liable to tax if the services are rendered in Malaysia.

0 0 votes. It should be noted that this takes into account all. 3 Indirect Tax 7 4 Personal Taxation 8 5 Other Taxes 9 6 Free Trade Agreements 10 7 Tax Authorities 11.

Income tax rates 2022 Malaysia. If taxable you are required to fill in M Form. Tax relief for individual taxpayer whose spouse has no income is increased from RM3000 to RM4000.

The Malaysian 2020 budget raised the maximum tax rate an individual could pay to 30 percent from 28 percent. Chargeable Income Calculations RM. Malaysia Taxation and Investment 2016 Updated November 2016 Contents 10 Investment climate 11 Business environment.

Malaysia Income Tax Rates 2014 and 2015 and Deductions Malaysia Income Tax Rate for Individual Tax Payers. PwC 20162017 Malaysian Tax Booklet PERSONAL INCOME TAX Tax residence status of individuals. Rates of tax Personal reliefs for resident individuals.

Malaysia Non-Residents Income Tax Tables in 2019. Assessment Year 2016 2017 Chargeable Income. Taxable income MYR Tax on column 1 MYR Tax on excess Over.

Malaysia Personal Income Tax Rate. Based on your chargeable income for 2021 we can calculate how much tax you will be paying for last years assessment. Rate TaxRM A.

To ensure a more progressive tax structure the chargeable income subject to the maximum rate will be increased from exceeding RM100000 to exceeding RM400000. While the 28 tax rate for non-residents is a 3 increase from the previous. Tax rates in Malaysia.

Purchases of books sports equipment smartphones gym memberships computers and internet subscription are allowed up to RM2500 tax relief. Friday 23 Oct 2015. Malaysia Personal Income Tax Rates 2022.

Budget 2016 Malaysia. 2021 ITRF Submission Dateline. On the First 5000 Next 15000.

Resident individuals are eligible to claim tax rebates and tax reliefs. On the First 2500. This translates to roughly RM2833 per month after EPF deductions or about RM3000 net.

Below are the Individual Personal income tax rates for the Year of Assessment 2021 provided by the The Inland Revenue Board IRB Lembaga Hasil Dalam Negeri LHDN Malaysia. Information on Malaysian Income Tax Rates.

Malaysia Payroll And Tax Activpayroll

Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News

Malaysia Five Takeaways From The New Oecd Economic Survey Ecoscope

Individual Income Tax In Malaysia For Expatriates

10 Things To Know For Filing Income Tax In 2019 Mypf My

Irs Announces 2016 Tax Rates Standard Deductions Exemption Amounts And More

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

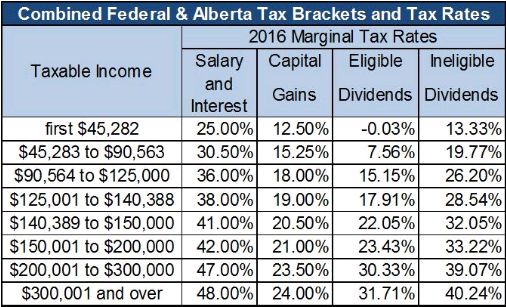

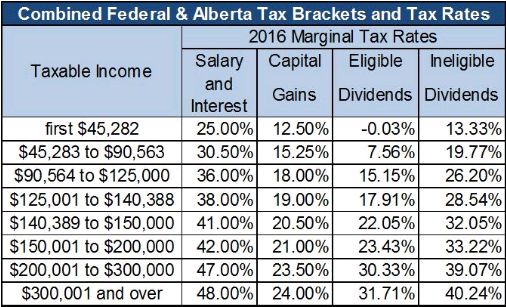

2016 Alberta Budget Capital Gains Tax Canada

Malaysian Tax Issues For Expats Activpayroll

Malaysia Personal Income Tax Rates Table 2012 Tax Updates Budget Business News

Malta Corporate Tax Rate 2021 Data 2022 Forecast 1995 2020 Historical Chart

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

Why Ph Has 2nd Highest Income Tax In Asean

Irs Announces 2016 Tax Rates Standard Deductions Exemption Amounts And More

Malaysia Number Of Households Statista

Does Denmark Need Yet Another Tax Reform Ecoscope

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Tax Guide For Expats In Malaysia Expatgo